Taxation and dead weight loss.

Price floor and price ceiling articles 2017.

Example breaking down tax incidence.

First posted september 20 2017 19 24 12 more stories from western australia.

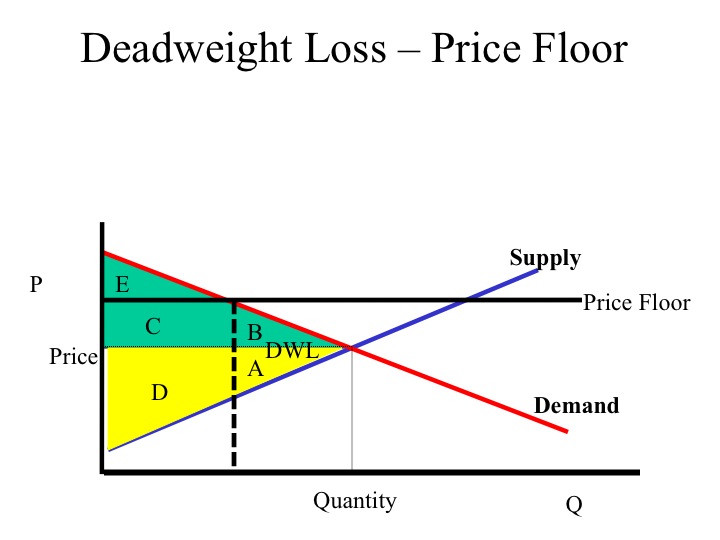

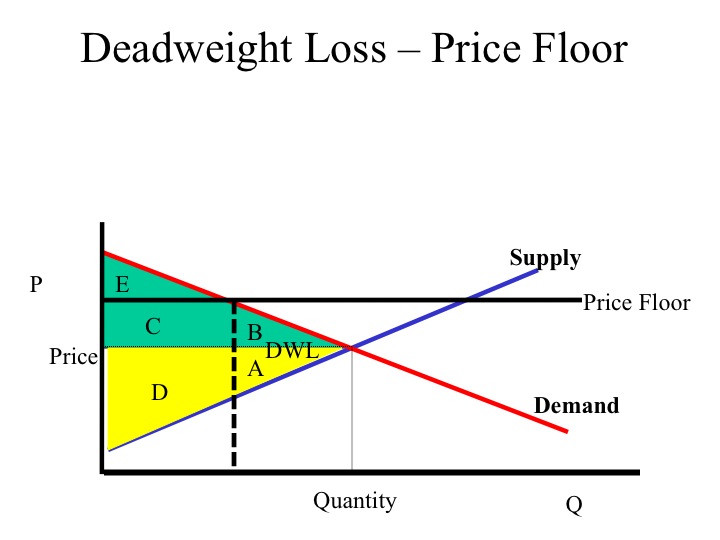

Price and quantity controls.

A price floor or a minimum price is a regulatory tool used by the government.

A non binding price ceiling is ineffective due to the fact that the present equilibrium price is already below the price ceiling.

Percentage tax on hamburgers.

Taxes and perfectly inelastic demand.

For instance if the government sets the ceiling for potatoes at 5 per pound but the equilibrium price for potatoes is already 4 per pound this would have no real effect on the price of potatoes.

Farmers would receive 45 of the difference between the milk price floor and the current all milk price.

A price ceiling is the legal maximum price for a good or service while a price floor is the legal minimum price.

More specifically it is defined as an intervention to raise market prices if the government feels the price is too low.

Payments to farmers would then be 3 30 cwt.

Like price ceiling price floor is also a measure of price control imposed by the government.

The price ceiling for premium rice or those usually semi transparent in color found in bulk or packaged with 14 percent maximum water rate and 15 percent broken rice rate is rp 12 800 per kg in.

The effect of government interventions on surplus.

A floor price is a minimum amount under which alcohol cannot be sold.

But this is a control or limit on how low a price can be charged for any commodity.

This is the currently selected item.

Price ceilings and price floors.

For instance if milk prices were 16 cwt the difference would be 7 34 cwt.

A price ceiling example rent control.

It is legal minimum price set by the government on particular goods and services in order to prevent producers from being paid very less price.

If the price is not permitted to rise the quantity supplied remains at 15 000.